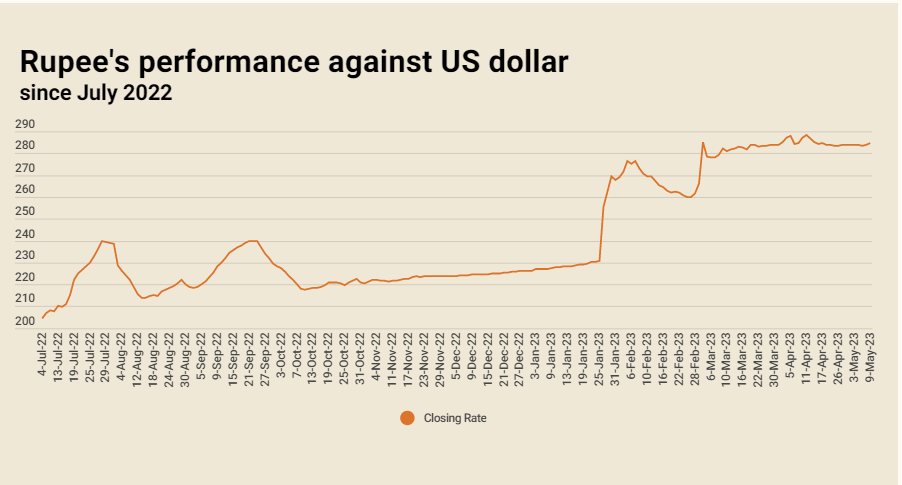

The State Bank of Pakistan (SBP) reported that the local currency closed at 284.84, a decrease of 0.99 Re.

On Monday, the rupee weakened against the U.S. dollar, concluding at 283.85 on the interbank market.

In a related development, Moody’s Investor Service warned on Tuesday that Pakistan could default without a rescue from the International Monetary Fund (IMF), as the country faces uncertain financing options beyond June.

Bloomberg quoted Grace Lim, a sovereign analyst at a ratings firm in Singapore, as saying, “We believe Pakistan will be able to meet its external payments for the remainder of this fiscal year, which ends in June.”

0.35 percent currency depreciation on the inter-bank market

“However, Pakistan’s financing alternatives beyond June are extremely dubious. Without an IMF program, Pakistan’s meager reserves could lead to insolvency.”

In the meantime, the Ministry of Finance announced on Tuesday that arrangements have been made for the repayment of a $3.7 billion debt due in May and June.

Since November of last year, Pakistan has been unable to resume its bailout program, which has been halted at the ninth review.

Globally, the US dollar inched higher on Tuesday after a loans survey revealed less dismal US credit conditions than anticipated, while the British pound flirted with a one-year high on expectations that the Bank of England will raise interest rates this week.

The Federal Reserve’s quarterly Senior Loan Officer Opinion Survey (SLOOS) indicated that while credit conditions for US businesses and households continued to tighten at the beginning of the year, it was likely due to the Fed’s aggressive rate hikes rather than severe banking sector stress.

The US dollar index rose 0.03% against a basket of currencies to 101.47, but remained close to recent lows as traders anticipate a rise in US interest rates.

Oil prices, a key indicator of currency parity, declined on Tuesday, giving up some of the robust gains of the previous two sessions, as the market remained cautious ahead of US inflation data, which will be crucial to the Federal Reserve’s upcoming interest rate decision.

Tuesday interbank market rates for the greenback

BID Rs 284.85

OFFER Rs 287.00

Open-market movement

On the open market, the PKR lost two rupees against the USD, closing at 287 and 290, respectively, for purchases and sales.

The PKR lost 1 rupee against the Euro on both the purchase and sell, closing at 314 and 317, respectively.

The PKR lost 80 paisa for purchasing and 95 paisa for selling against the UAE Dirham, closing at 78.50 and 79.25, respectively.

The PKR lost 60 paisa for purchasing and 75 paisa for selling against the Saudi Riyal, closing at 76.50 and 77.25, respectively.

Open-market rates for the dollar on Tuesday

BID Rs 287

OFFER Rs 290