According to Fintel’s data, Maxim Group kept their Buy rating on Vertex Pharmaceuticals (NASDAQ:VRTX) on May 3, 2023.

A 1.22 Percent Price Drop Is Expected, According to Analysts

The average price estimate for Vertex Pharmaceuticals for the next year is $342.13 as of April 24, 2023. Predictions are between $282.80 and $460.95. From its last closing price of $346.36, the average price target is a decline of 1.22 percent.

Check out the top gainers in our price target rankings.

Vertex Pharmaceuticals expects yearly sales of $9,756 MM, up 5.95% from last year. Non-GAAP EPS is expected to be $16.14 per year.

Which is the Fund’s Mood?

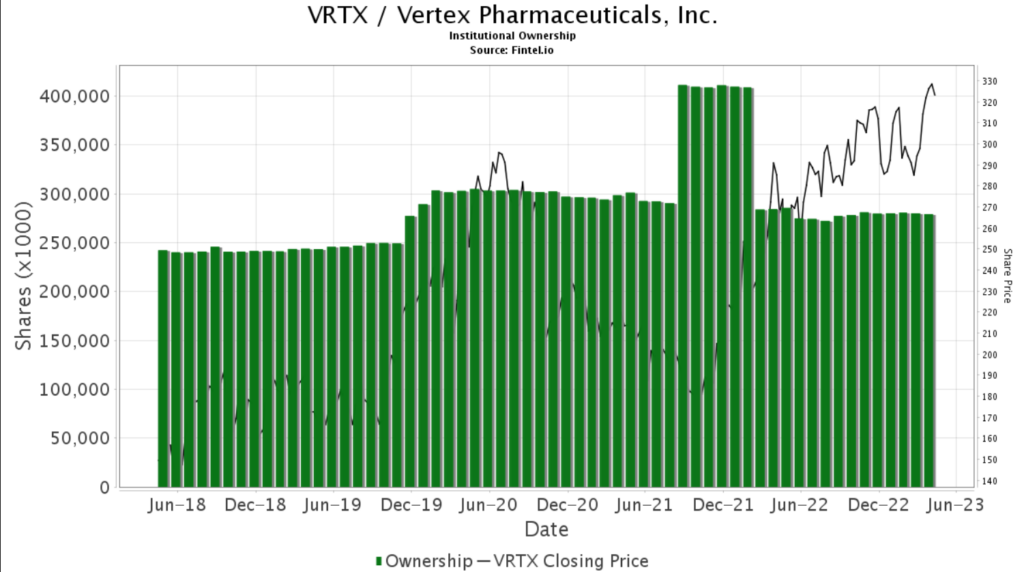

A total of 2497 different institutions and/or funds have indicated that they are long on Vertex Pharmaceuticals. There was a quarterly rise of 4.56%, or 109 new owners. The average allocation of all funds for VRTX dropped to 0.55% from 7.30%. Institutional holdings of stock fell by 0.62 percent, or 27,880 shares, during the preceding three months.

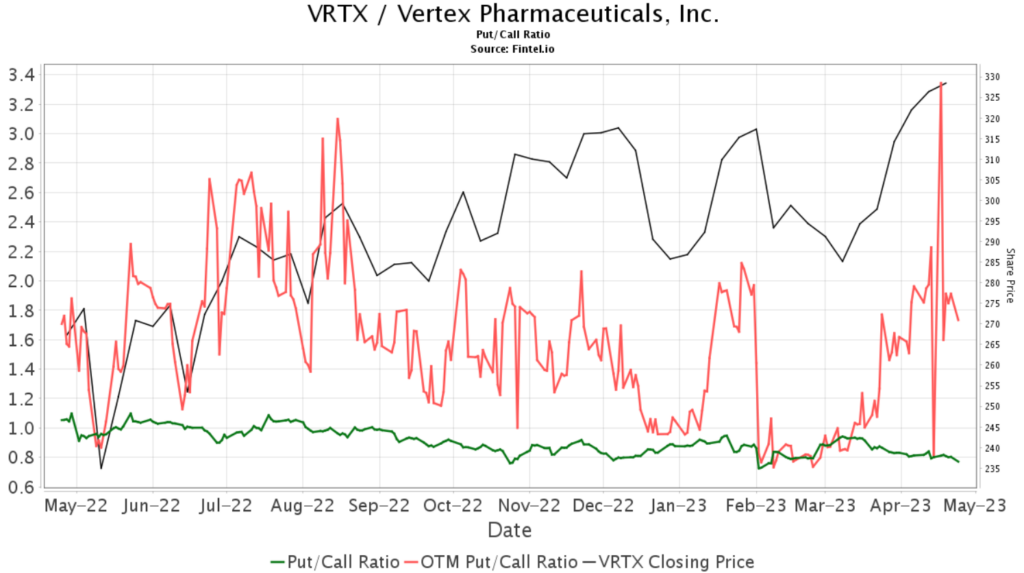

Equivalent Put/Call Ratios for VRTX/Vertex Pharmaceuticals, Inc.The 0.84 put/call ratio for VRTX suggests a bullish market.

Is Anyone Else Investing?

Securities of VRTX/Vertex Pharmaceuticals, Inc. 12 769 000 shares (4.96% of the firm) are held by Capital World Investors, an institutional investor. The company now owns 12,525,000 shares, up from 12,250,000 in the previous filing, or a 1.91% gain. Over the past quarter, the company’s portfolio allocation in VRTX was reduced by 3.46%.

Alliancebernstein owns 3,52 % of the firm thanks to its 9,070,000 share holdings. The company now owns 9,146K less shares than it did in its previous filing, a drop of 0.84 percent. Over the past quarter, the company’s portfolio allocation to VRTX was reduced by 8.16 percent.

There are 7,803,000 shares in the Vanguard Total Stock Market Index Fund Investor Shares (VTSMX), which means that the fund owns 3.03% of the firm. The company now officially has 7,648K shares, an increase of 1.99% from its last filing. Over the past quarter, the company’s portfolio allocation to VRTX was reduced by 6.03%.

With its 6,828k shares, Wellington Management Group Llp controls 2.65% of the firm. The most recent quarter showed no changes.

The 5,934,000 shares owned by VFINX – Vanguard 500 Index Fund Investor Shares represent 2.30 percent of the company’s total shares outstanding. The company now officially has 5,814K shares, an increase of 2.03% from its last filing. Over the past three months, VRTX accounted for 6.21 percent less of the company’s portfolio.