Brad Smith of Yahoo Finance joins the Live broadcast to analyze Amazon’s first-quarter earnings report.

Video Transcript

DIANE KING HALL: Amazon is also a priority. Amazon’s stock is actively trading after hours. We’re now receiving their earnings. Brad Smith provides the statistics.

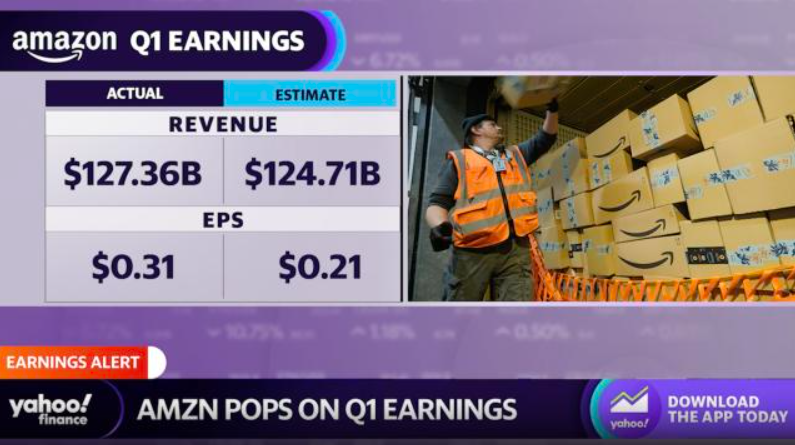

BRAD SMITH: Hey. Yes, thank you very much. As you can see in extended hours right now, Amazon is reacting positively to the earnings, as are Amazon’s stock prices. It was a win on both the top and bottom lines. The consensus estimate for EPS was $0.21 per share. Arrived at $0.31 per share.

Revenue, which was anticipated to be $124.7 billion, was approximately $127.4 billion. So that increased annually.

Examining some of the individual lines for Amazon’s — or Amazon’s segment, AWS.

Numerous investors will concentrate on this. This is a $20 billion industry. It actually generated $21.4 billion in revenues here. And ultimately, this exceeds what analysts had anticipated as well. The Bloomberg consensus estimate for the quarter was $21.03 billion, so AWS also outperformed expectations.

In addition, they praised their advertising business, noting that it continues to experience robust growth as a result of their continued machine learning investments. Those of you who had artificial intelligence on your Amazon bingo card during this earnings report have received it.

Using their uniquely cost-effective machine learning processors, “Ter-minimum,” Trainium, they claim to be able to leverage language technologies, large language models, and generative AI with greater ease. We will learn more about the names of these chips. There have been several intriguing ones during this earnings season.

DAVE BRIGGS: You got me, buddy.

Trainium and Inferentia, according to BRAD SMITH. We’re going to handle these situations appropriately. I’m not even going to consider that option. Managing large language models with Bedrock and, naturally, CodeWhisperer. So, disregarding these names, focus on the upper and bottom lines.

Additionally, sales guidance outperformed there as well. As I continue to navigate through this page, I am using my minuscule phone, despite the fact that it is a plus and pro model. But ultimately, I’m still sifting through this page for Prime members.

In addition, we have already received references to generative AI. But with regard to Prime members specifically, they anticipate a total of approximately 248.87 million, which would represent a net increase of 4.6 million. So, while we are here discussing Amazon, I am merely searching to see if I can locate that number. As you can see, however, the current reaction to AMZN is extremely positive, and the company is currently delivering positive earnings.

DAVE BRIGGS: Looking into the growth rate of AWS because Azure has a growth rate of 27%. Google, 28%.

The concern now is whether or not they will be able to maintain their current pace.

BRAD SMITH: I actually have that number for you.

DAVE BRIGGS: Excellent. We received it.

BRAD SMITH: Therefore, even at the figure anticipated by Wall Street, AWS would have experienced a 13% growth rate. However, it came in just marginally higher. Hence, $21.03 billion was anticipated. It came in at 21,4, so slightly above the growth rate anticipated by Wall Street as a whole. In addition, a 17% increase in ad services was anticipated in this quarter.

SEANA SMITH: Yeah. I’m also looking at the employment statistics here, Brad. 10% employment decline. And I bring this up because it means that Amazon employs approximately 1.47 million people in total. A decline of this magnitude exceeds Amazon’s announced corporate reductions.

This indicates that some warehouse employees have been laid off, which is typical for Amazon during the first quarter. However, this is indicative of Amazon’s recent cost-cutting measures. It will probably continue to —

DIANE KING HALL: Absolutely.

SEANA SMITH: –to oversee the upcoming months in this location. However, the slight decline of about 10% indicates that some of their cost-cutting efforts are currently under control.

DAVE BRIGGS: Expect to hear more on this topic. I imply that —

SEANA SMITH: Of course.

DAVE BRIGGS: Now, some background on that number; you mentioned 1.4 or something. They had been

SEANA SMITH: The total [INAUDIBLE] is seven million.

Pre-COVID, there were approximately 800,000 of them. They began with 800,000, increased to 1.6, and are now reducing their numbers. A hundred positions were eliminated from the Amazon Studios and Prime Video divisions, though the reductions were very minimal, Seana. It was only unexpected because they are increasing content spending in both of these units.