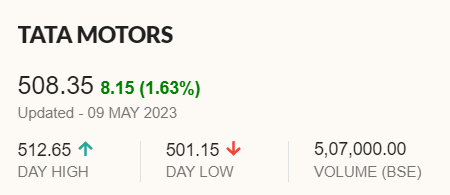

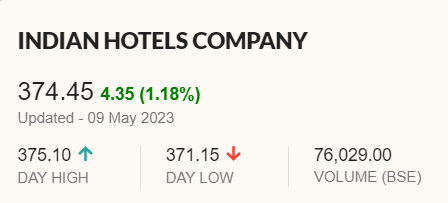

Monday trading saw Tata Motors and Indian Hotels Company achieve 52-week highs. On NSE, Indian Hotel shares reached a lifetime high of 369.80.

Both Rekha Jhunjhunwala stocks have risen since 2023. In YTD time, Tata Motors shares have increased from 395 to 499.50, giving shareholders a 25% gain. Indian Hotels’ share price rose from 317 to 369.80 YTD, delivering stockholders a 15% gain.

Jhunjhunwala’s stake

Rekha Jhunjhunwala has 5,22,56,000 Tata Motors shares, 1.57 percent of the company’s paid-up capital, according to the January–March 2023 ownership pattern.

In Q4FY23, Rekha Jhunjhunwala had 3,00,16,965 Indian Hotels shares, 2.11 percent of the company’s paid-up capital.

Indian Hotels Q4 results were released on April 27, 2023, while Tata Motors Q4 results are scheduled on Friday, May 12. The January-March 2023 quarter saw India’s largest hospitality company’s net profit grow 343 percent to 328.27 crore. The same quarter in FY22 had a net profit of 74.2 crore. The Tata group hospitality company’s operations revenue climbed 86.4 percent to 1,625.4 crore from 872.1 crore.

“IHCL achieved a record-setting year with a number of significant accomplishments including the highest ever full-year consolidated revenue, an all-time high, and industry-leading EBITDA margin and PAT of over INR 1,000 crores a historic first for the company,” said Puneet Chhatwal, Managing Director & CEO, IHCL, when announcing Q4 results. IHCL’s RevPAR leadership in all its core markets and four straight quarters of robust demand allowed this success.