There are a few things to keep a watch out for if you’re searching for a multi-bagger. First, we’ll be looking for an increasing return on capital employed (ROCE), followed by an expanding base of capital employed.

Ultimately, this demonstrates that the company is reinvesting profits at a rate of return that is rising. In light of this, we were less than enthusiastic about Siltronic (ETR: WAF) and its ROCE trend.

Return On Capital Employed (ROCE): An Explanation

ROCE assesses the return (pre-tax profit) generated by a company’s capital employed in its business. Analysts calculate it using the following formula for Siltronic:

Earnings Before Interest and Taxes (EBIT) (Total Assets – Current Liabilities) = Return on Capital Employed.

0.11 = €408m ÷ (€4.1b – €555m) (Based on the twelve months preceding March 2023.

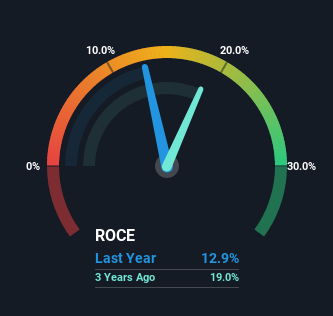

Therefore, Siltronic’s ROCE is 11%. This is a fairly average return in absolute terms, but it lags behind the Semiconductor industry average.

In the preceding illustration, we compared Siltronic’s historical ROCE to its historical performance, but the future is arguably more significant. You can view the forecasts of the analysts covering Siltronic for free on this page.

How do returns trend over time?

When we examined Siltronic’s ROCE trend, we did not gain much confidence. Prior to roughly five years ago, returns on capital were 25%, but have since dropped to 11%.

Nevertheless, given that both revenue and the quantity of assets employed by the business have increased, it is possible that the company is investing in growth, resulting in a temporary decline in ROCE. And if the additional capital generates additional returns, the company and its shareholders will ultimately benefit.

Our Opinion About Siltronic’s ROCE

In conclusion, despite reduced short-term returns, it is encouraging to see that Siltronic is reinvesting for development, resulting in higher sales. However, these development trends have not resulted in growth returns, as the stock has declined 32% over the past five years.

Therefore, we recommend conducting additional investigation on this stock to determine what other fundamentals of the company can tell us.

In conclusion, we discovered 3 warning signals for Siltronic, of which 2 are concerning.

Check out this free list of companies with stable balance sheets and impressive returns on equity if you’re looking for dependable businesses with high profits.