Microsoft (MSFT(opens in new tab)) stock’s glory days seemed to be over as sales of desktop PCs plummeted due to the consumer migration to mobile technologies. After the tech bust, MSFT shares traded mainly sideways for more than a decade.

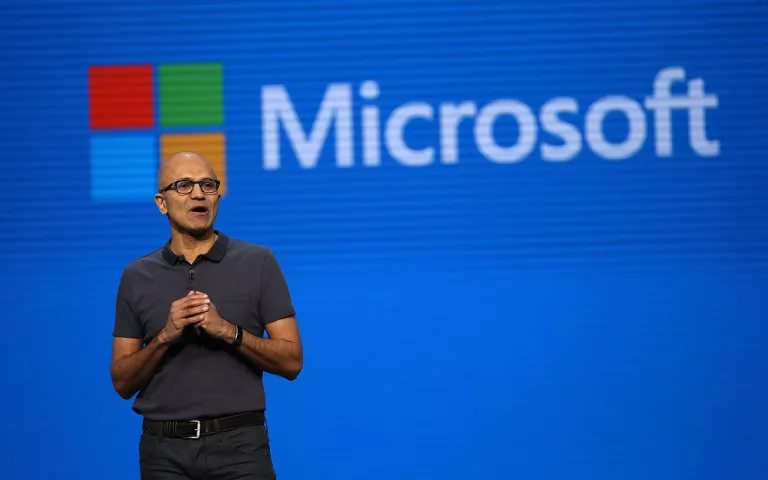

The software giant’s revival has lasted 10 years. In 2014, CEO Satya Nadella changed Microsoft’s strategy and culture. Cloud computing and subscription-based services replaced CD-ROM software licenses.

Microsoft’s concentration on commercial customers and, most critically, its migration to cloud-based services like Azure and Office 365 have been huge successes. Microsoft’s stock price shows it dominates cloud computing.

Since Nadella took over, Microsoft stock has been so profitable that long-term investors may not even remember the decade-plus after the tech bust. Microsoft, which joined the Dow in 1999 after the dot-com boom, returned 57,730% between 1990 and 2020. The S&P 500’s total return was 1,950%.

According to Hendrik Bessembinder, finance professor at Arizona State University’s W.P. Carey School of Business, Microsoft shares earned $1.91 trillion in wealth for stockholders, an annualized dollar-weighted return of 19.2%.

Bessembinder’s findings, which account for cash flows in and out of the business and other adjustments, show that MSFT was one of the finest stocks of the previous 30 years, trailing only Apple (AAPL(opens in new tab)).

Microsoft stock performance

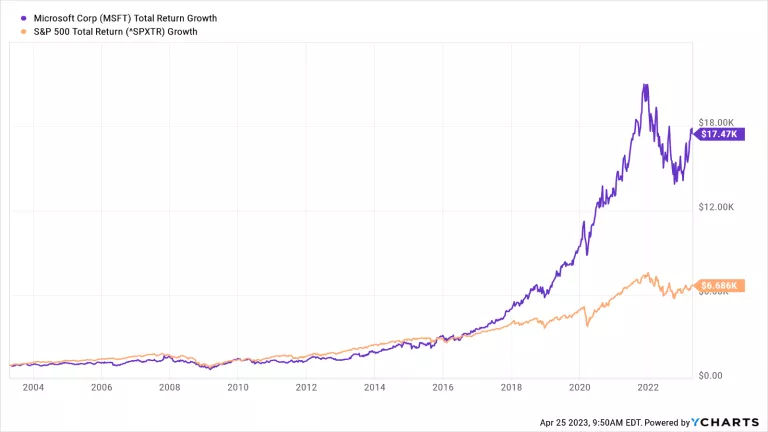

What would $1,000 put in MSFT stock 20 years ago be worth today?

But first. As shown in the figure, if you invested $1,000 in MSFT stock in late April 2003 and sold at its peak in November 2021, you would have made over $21,000.

MSFT stock is 18% below its all-time closing high, dropping $480 billion in market value. Eight S&P 500 firms, including Microsoft, have market capitalizations over $500 billion.

Thus, 20 years later, that $1,000 investment is worth $17,500. A same investment in the S&P 500 would be worth $6,700 today.

That’s still a great return. MSFT has had a 26% annualized total return (price movement + dividends) since becoming public. The S&P 500 returned almost 10% over the same period.

Microsoft stock—buy, sell, or hold?

Most importantly, Wall Street expects Microsoft stock to outperform the market. MSFT tops analysts’ Dow 30 stock rankings and hedge funds’ stock choices.

Look at MSFT stock’s Street rating. S&P Global Market Intelligence’s 51 analysts rate Microsoft shares as Strong Buy, Buy, Hold, or Strong Sell. That’s close to a Strong Buy consensus.

We’ll allow a bull, Stifel analyst Brad Reback, who puts MSFT at Buy, summarize Microsoft’s investing thesis:

Microsoft has refocused on Azure and Office 365, which we see as substantial, multi-year secular growth engines that should deliver mid- to high-single-digit Productivity and Business Process growth and low-double-digit Intelligent Cloud growth in the coming years.

Bing, Surface, and Xbox are growing in More Personal Computing, but we remain wary on Windows. Strong commercial cloud revenue and gross margin growth and expenditure discipline should accelerate operating profit and free cash flow in coming quarters.

This, along with continuous capital return (more than $20 billion in yearly buybacks/dividends), should allow Microsoft to produce high-single-digit total returns (earnings per share growth + dividend yield) in coming years.

Analysts expect Microsoft stock to rise 10% in the next year with an average price target of $306.97. The implied total return is 11% with dividend yield.

MSFT stock would climb 50% if the Street’s top $420 target price is reached. Microsoft stock’s probable downside over the next year is 25% based on the Street’s lowest price objective of $212.

Microsoft’s future is unknown. $1,000 bought in MSFT stock 20 years ago crushed the market.