On Wednesday, Varun Beverages joined the exclusive community of companies with a market capitalization of one trillion rupees. Over the past year, the stock of a bottling company has more than doubled due to consistent top-line growth and market share gains, which have boosted investor sentiment.

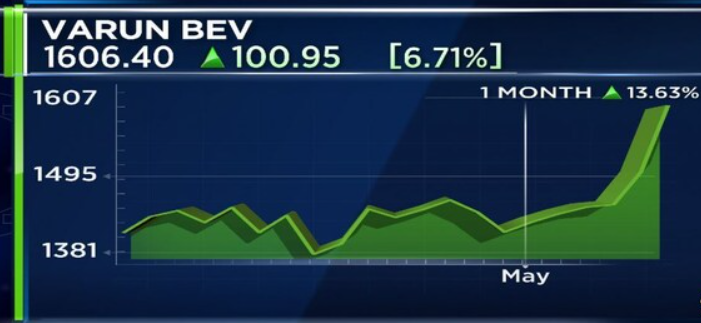

On Wednesday, shares of Varun Beverages increased by close to seven percent, their largest single-day increase in the past three months. The stock has gained 21.5% thus far in 2023, following a massive 123.5% return in 2022.

Varun Beverages joins Rs 1 lakh crore market cap club

According to market participants, Varun Beverages continues to benefit from its partnership with PepsiCo, pan-India distribution network, backward integration, and increased consumption at home. The company has added multiple growth vehicles, including the introduction of Sting and dairy products, as well as consistent investments in capex and visi refrigerators.

ICICI Securities, which has a “Hold” rating on the stock, stated: “While we remain positive on Varun Beverages, we believe the stock price upside is capped at current valuations (41x CY24E), hence we maintain HOLD with a revised DCF-based target price of Rs1,400.”

Varun Beverages’ March quarter profit increased by 69 percent year-over-year to Rs 429 crore. The company’s net revenue increased by 38 percent to Rs 38.93 crore as a result of robust volume growth and higher net realization.

Over the past five years, the company’s sales volume has increased at a CAGR of 24%. During the same period in which net revenue increased at a CAGR of 26.7 percent, EBITDA and PAT increased at rates of 35.1% and 50.8%, respectively.