First Republic Bank became the third significant bank failure in the United States in less than two months after regulators took control of it and sold a sizable portion of its assets to JPMorgan Chase.

After briefly taking over First Republic over the weekend, the Federal Deposit Insurance Corporation (FDIC) oversaw the sale in what it calls a “highly competitive bidding process.”

In a press release, JPMorgan stated that it will acquire First Republic’s deposits as well as a “substantial amount of their assets and certain liabilities.”

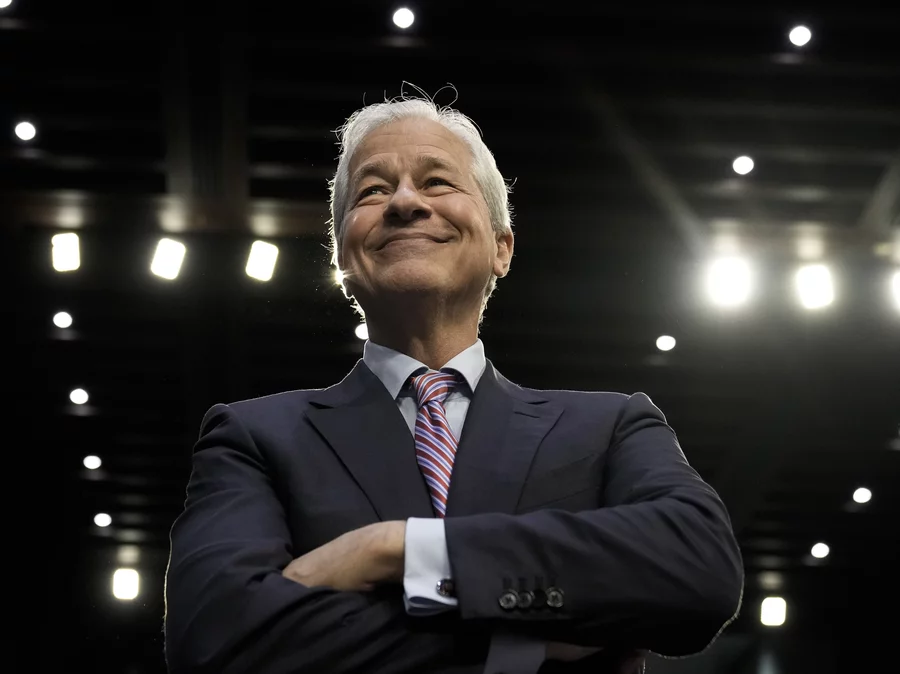

JPMorgan Chase CEO Jamie Dimon stated in a statement, “Our government invited us and others to step up, and we did.” This transaction adds moderate value to our business overall, is accretive to shareholders, advances our wealth goal, and strengthens our current franchise.

On Monday, the 84 First Republic locations became JPMorgan Chase Bank locations, and customers now have complete access to their funds.

Its takeover is the latest development in a string of banking turbulence that has shaken the nation’s financial system and caps a trying week for First Republic.

Since the United States acquired Silicon Valley Bank and Signature Bank in March, First Republic has struggled, but its downward spiral really started last Monday when it revealed that it had lost approximately $100 billion in deposits in the first three months of the year.

Last week, its stock fell so sharply that the New York Stock Exchange had to repeatedly halt trading. Shares fell more than 97% year to date as of Friday’s closure, closing at $3.51.

President Biden praised the purchase and sale of First Republic on Monday, saying it would “ensure that the banking system is safe and sound,” while emphasizing that taxpayers would not be responsible for the rescue.

A downward spiral

Since 2008, when JPMorgan Chase also purchased Washington Mutual, First Republic is the biggest American lender to fail.

Federal regulators intervened in March to defend Silicon Valley Bank and Signature Bank clients after both lenders experienced a run on the bank as depositors rushed to withdraw their funds.

Regulators took unprecedented measures to guarantee all deposits at the two banks, even those that surpassed the FDIC’s $250,000 insurance threshold, citing possible risk to the wider financial system.

After those two lenders failed, a hunt was launched for additional lenders who might be exposed to deposit outflows, and First Republic was soon found.

The San Francisco-based bank, which was established in 1985, primarily catered to rich customers by providing commercial loans and house mortgages.

In an effort to restore confidence, 11 of the largest banks in the nation, led by JPMorgan, placed $30 billion in First Republic in March.

Wall Street was eventually unconvinced by those actions, and customers kept withdrawing cash.

Few options remained for First Republic.

Then First Republic tried to sell itself, but there weren’t many buyers, so the only option left was a government-led rescue.

The largest lender in the nation, JPMorgan, won after the FDIC requested bids from a number of banks.

The bank made its offer for First Republic in a method that would “minimize costs” to the FDIC’s Deposit Insurance Fund, according to JPMorgan’s Dimon.

According to the FDIC, First Republic’s acquisition and sale will cost the fund around $13 billion.

According to JPMorgan, the transaction included “assumption of approximately $92 billion of deposits” held by First Republic as well as the purchase of around $173 billion in loans and $30 billion in assets.

Banking anxiety has decreased

The atmosphere is currently calmer, in contrast to Silicon Valley Bank and Signature, whose failures had the potential to start other bank runs.

Smaller bankers’ earnings reports this month showed that deposit outflows have essentially steadied.

Jared Shaw, a bank analyst at Wells Fargo Securities, said “that fear, that mass exodus, that people were concerned about just didn’t happen,” adding that lenders were proactive.

Reaching out to their clients and explaining their balance sheets and sources of liquidity was one of the things the banks did exceptionally well.

Federal regulators were also quick to emphasize that First Republic’s difficulties were not indicative of broader issues in the banking sector.

According to a U.S. Treasury spokesperson, “Americans should feel confident in the safety of their deposits and the ability of the banking system to fulfill its essential function of providing credit to businesses and families.”

In remarks he made to reporters after the deal was announced, Dimon echoed that.

He declared, “The system is very, very sound.”

Now focusing on bank regulations

The FDIC’s measures come at a time when regulators are being questioned about whether they could have done more to stop Silicon Valley Bank and Signature Bank from failing.

The bankruptcy of Silicon Valley Bank was partially attributable to the Federal Reserve, which admitted on Friday that it should have exercised more aggressive monitoring of the lender.

The Fed also advocated for a stricter approach to bank regulation, which would involve subjecting more smaller lenders to greater Fed supervision.

In the meanwhile, the FDIC released a report on Monday proposing potential adjustments to the nation’s deposit system.

Offering unrestricted deposit insurance would probably be too expensive and encourage risky behavior by banks, according to the FDIC analysis.

However, it discovered that a targeted increase in the insurance limit for a select group of business accounts might be advantageous, particularly when combined with other measures like restrictions on quick bank withdrawals.

The deposit insurance system would need congressional approval for any changes.