By purchasing an index fund, it is simple to mirror the market’s return. However, if you buy individual securities, you can do better or worse. The share price of Glacier Bancorp, Inc. (NYSE: GBCI) fell 27% over the past year.

This is disappointing in light of the market decline of 0.01%. In the last three years, the stock has declined by 13%, so at least the damage is not too severe.

Moreover, it has decreased by 27% in roughly a quarter. This is not enjoyable for holders. We observe that the company reported results not too long ago, and the market is hardly ecstatic. The most recent figures are available in our company’s report.

Since Glacier Bancorp has lost $246 million in market value over the past week, let’s examine whether the longer-term decline is due to the company’s economics.

View our most recent analysis of Glacier Bancorp.

While some continue to teach the efficient markets hypothesis, it has been demonstrated that markets are overreactive dynamic systems and investors are not always rational. Comparing the change in earnings per share (EPS) to the change in the share price is an imperfect but simple method to evaluate how the market’s perception of a company has shifted.

During the year in which the share price of Glacier Bancorp declined, the company’s earnings per share (EPS) increased by 1.6%. Obviously, the situation may reveal past overconfidence in economic growth.

It appears plausible that the market anticipated a higher growth rate for the stock. However, alternative metrics may better explain the share price change.

Last year, Glacier Bancorp was able to increase its revenue, which is generally a positive development. Since we cannot readily explain the share price movement based on these metrics, it may be worthwhile to consider the stock’s changing market sentiment.

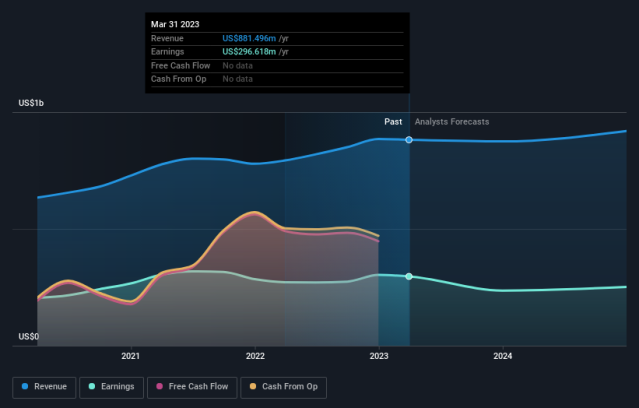

The graph below illustrates the evolution of earnings and revenue over time (you can view greater detail by clicking on the graph).

It’s worth noting that we’ve witnessed considerable insider buying in the last quarter, which we view as a positive development. However, we believe that trends in earnings and revenue growth are more important considerations. This interactive graph displays future profit forecasts for Glacier Bancorp as predicted by analysts.

A Different Viewpoint

While the broader market lost approximately 0.01% over the past year, Glacier Bancorp shareholders lost 25% (including dividends). In a falling market, however, it is inevitable that some equities will be oversold. The key is to focus on the most fundamental changes. Positively, long-term shareholders have made money, gaining 0.6% per year over the past five years.

If fundamental data continue to indicate sustainable development over the long term, the current sell-off could represent an opportunity. I find it extremely fascinating to examine long-term share price as a proxy for business performance. But to obtain true insight, we must also consider additional data. Take risks; for instance, Glacier Bancorp has two warning signals (and one that is somewhat concerning) that you should be aware of.

Glacier Bancorp is not the only stock being purchased by insiders. This free list of thriving companies with recent insider purchases may be just what the doctor ordered for those who seek profitable investments.

Please note that the market returns cited in this article reflect the market-weighted average returns of stocks presently trading on U.S. exchanges.