Investing in an index fund can approximate the average market return. However, if you buy individual securities, you can do better or worse. In the past year, shareholders of Kennedy-Wilson Holdings, Inc. (NYSE:KW) have experienced a 31% decline in share price. That is considerably less than the 3.6% market decline. Positively, the stock has gained 19% over the past three years.

Now let’s examine the company’s fundamentals to determine if the long-term shareholder return matches the underlying business’ performance.

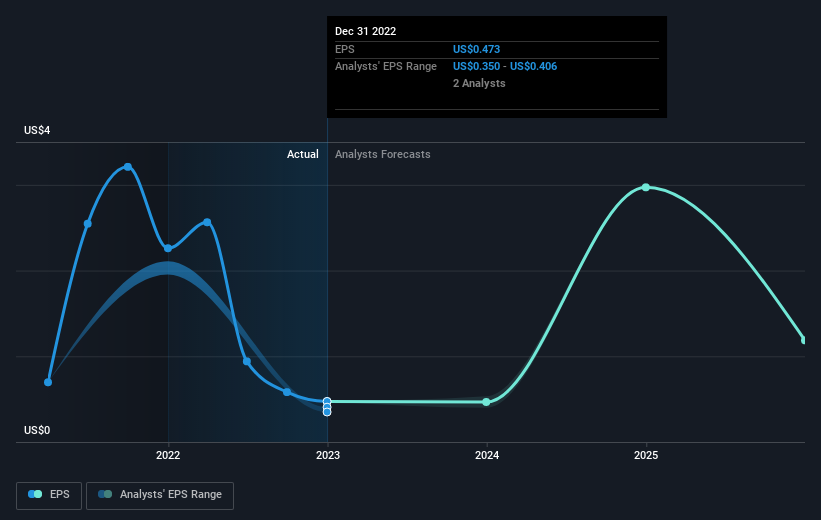

While markets are a potent mechanism for pricing, stock prices also reflect investor sentiment in addition to underlying business performance. Examining the relationship between a company’s share price and its earnings per share (EPS) is one method for determining the evolution of market sentiment.

Over the past year, Kennedy-Wilson Holdings was forced to report a 79% decline in EPS. The 31% decline in share price is less severe than the decline in earnings per share. Therefore, the market may not be overly concerned with the EPS figure at the time, or it may have anticipated a faster decline.

The graph below depicts the evolution of EPS over time.

We view it favorably that insiders have made substantial purchases over the past year. However, the majority of people consider trends in earnings and revenue growth to be a more reliable indicator of a company’s performance.

Before purchasing or selling a stock, we always advise a thorough examination of its historical growth trends, which can be found here.

What Regarding Dividends?

For any given stock, it is essential to consider both the total shareholder return and the share price return. TSR incorporates the value of dividends (assuming they were reinvested) and the advantage of any discounted capital raising or spin-off, whereas the share price return only reflects the change in the share price.

Consequently, the TSR is frequently substantially greater than the share price return for companies that pay a generous dividend. The one-year TSR for Kennedy-Wilson Holdings was -27%, which exceeds the share price return mentioned earlier. The company’s dividend payments have increased the total shareholder return.

A Different Viewpoint

While the market as a whole lost about 3.6% over the past year, Kennedy-Wilson Holdings shareholders lost 27% (including dividends). Nonetheless, it is possible that the share price has been affected by broader market volatility. Keeping an eye on the fundamentals could be advantageous if a favorable opportunity arises.

Positively, long-term shareholders have made money, gaining 1.8% per year over the past five years. If fundamental data continue to indicate sustainable development over the long term, the current sell-off could represent an opportunity.

Although it is essential to consider the various effects that market conditions can have on the share price, other factors are more significant. Nevertheless, Kennedy-Wilson Holdings displays four red flags in our investment analysis, and two of them cannot be disregarded…