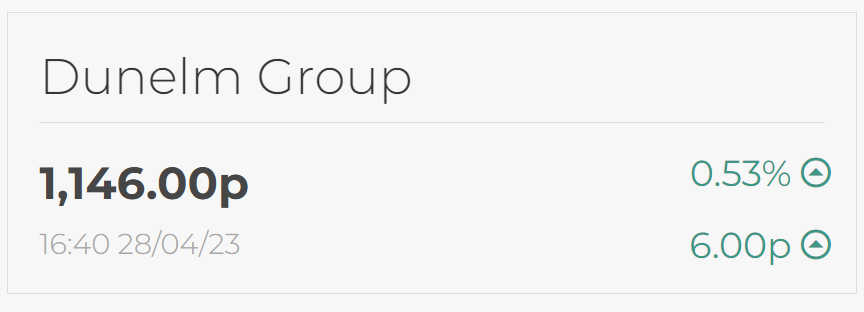

Deutsche Bank initiated coverage of homewares retailer Dunelm on Friday with a ‘buy’ rating and a price target of 1,313 pounds, arguing that the recent de-rating represents a purchasing opportunity.

Since its initial public offering in 2006, Dunelm has generated an impressive annualized equivalent return of 18%, according to the bank.

According to the report, the reduction in valuation since February presents a purchasing opportunity for a company with consistent delivery and compounding earnings growth.

“Dunelm is currently trading at a slight discount to its five-year pre-pandemic PE average of 15.3x, despite meriting a premium in our opinion due to its greater scale, category expansion, and online investment,” DB stated.

“Our in-depth analysis supports: 1) Additional market share gains driving sales growth despite a weak market; 2) Furniture expansion providing a significant sales tailwind; and 3) Robust cash conversion enabling ongoing cash returns to shareholders.”

Deutsche expects 5.5% sales growth and 7% profits per share growth for FY23-27.

The analysts at Berenberg reduced their price target for housebuilder Persimmon from 1,600.0p to 1,400.0p following the company’s first-quarter earnings report.

Berenberg still anticipates a “challenging market outlook” on a fundamental level, so it does not consider Persimmon’s valuation to be “attractive enough” to become more bullish in light of current macro uncertainties.

Berenberg noted that trading continues to recover from the low point in Q4 2022, but that consumer demand remains “substantially below” where it was a year ago.

In addition, the German bank noted that Persimmon stated pricing has “remained firm” and that private average selling prices were 10% higher than a year ago. Nonetheless, despite the fact that Berenberg believes this increase is due to a favorable mix effect rather than fundamental house price inflation, it stated that such price stability was reassuring.

Cost inflation continues high at 8 to 9 percent, and Persimmon sees “limited signs of easing in the short term.”

Berenberg, which maintained its ‘hold’ rating on the stock, stated, “We maintain the cautious view we have held on the stock and housebuilding sector since we began coverage in mid-2022… primarily due to the twin concerns of a significant deterioration in customer affordability and margin pressures.”

Moreover, in the face of such constraints, sector valuations, including that of Persimmon, have not been sufficiently attractive. Persimmon trades at 12x EPS, 1.1x TNAV, and a yield of 5%.”

Canaccord Genuity analysts reduced their price target for technology company RWS Holdings from 330.0p to 265.0p, citing a “biting” macroeconomic environment.

Canaccord Genuity stated that RWS’s recent interim trading update “negatively surprised to the downside” with an organic sales decline of approximately 7%, a significant acceleration from the prior half’s 3% decline.

The Canadian bank noted that RWS had cited several reasons for this, including rising pricing pressure and lower volumes among its large technology customers in language services, the impact of customer losses and approval delays in regulated industries, “muted growth” in software/technology, and “continued depressed spending” in IP services.

Canaccord observed that RWS did not formally reaffirm its organic growth guidance for this year of 4%, but based on the company’s poor first-half performance, it now deems this goal “impractical.”

“According to our reduced estimates, EPS for fiscal year 2023 is projected to decline by 12 percent year-over-year and to remain relatively flat thereafter, implying a 6 to 19 percent downside to consensus EPS expectations.” Canaccord maintained its ‘hold’ rating on the stock and set a new target price of 265p based on a c.11x cal. 2024E P/E multiple.