Samsung Electronics Co. reported a record $3.4 billion loss at its memory chip division but expects the global electronics industry to recover later this year.

It predicted reprieve from a tech slump that has affected Apple Inc. and Intel Corp. Asia’s largest electronics giant stated Thursday that a Chinese economic rebound and AI growth will only slowly boost demand in smartphones, PCs, and storage.

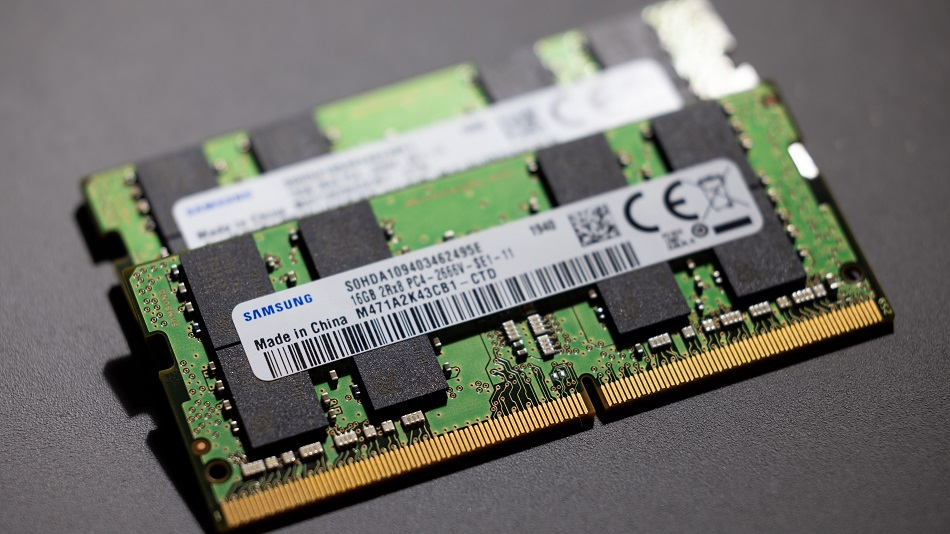

After a Covid-era spike in internet activity and gadget sales, Samsung has led a $160 billion global memory industry fall. Last year, consumer and company spending plummeted due to inflation and economic fears, hurting electronics sales globally.

The business, which sells processors to Apple and makes the iPhone’s closest competitor, posted net profits of 1.4 trillion won ($1.05 billion), below the 1.45 trillion won average analyst estimate. Its semiconductor sector lost 4.58 trillion won. Seoul shares remained mostly unchanged.

Eli Lee, head of investment strategy at Bank of Singapore, said the memory chip industry “likely passed the worst of weak demand” in the first quarter. In 2H23, new smartphone launches and AI demand increase will drive higher-end memory sales.

Samsung wants to preserve its long-term competitiveness by investing similarly in memory chips in 2023. Despite proposing a “meaningful” semiconductor production decrease to stabilize falling chip prices. The Korean corporation has spent during recessions to maintain its lead.

The mobile division earned 3.9 trillion won quarterly.

The unprecedented move and optimistic PC and phone demand estimates raised optimism that the industry would recover this year. Samsung’s statement boosted spot memory prices for the first time in 13 months.

On Wednesday, Hynix reported a smaller revenue loss than expected and said it expects memory prices to level out in the current quarter. Micron Technology Inc., the largest US memory chip maker, had already reported dwindling client inventories.

Samsung reported its lowest operational profit since 2009 a few weeks ago. China, the world’s largest PC and smartphone market, is crucial to a sustainable comeback. That recovery is accelerating.

“Amid signs of a global economic recovery, the smartphone market is expected to increase in volume and value in the second half,” it stated.

Samsung’s Galaxy S23 phone series withstood the smartphone recession, boosting March quarter profits.

Investors are still concerned about how a US-China dispute may effect the business. In March, Beijing reviewed Micron semiconductors, raising concerns about retaliation against American companies and allies. Samsung and Hynix manufacture in China, one of Korea’s biggest export markets.

This week, South Korean President Yoon Suk Yeol is visiting Washington to discuss Korea’s role in US export limitations to China, part of Washington’s effort to contain its political opponent. Samsung’s Chinese memory operations are threatened by a chipmaking equipment blockage.

Executives said Thursday they’re discussing with Washington about CHIPs and Science Act guardrails that limit federal funding for China expansions.

Ben Suh, chief of investor relations, said the US will gather industry comments and negotiate with individual companies. “We are studying various possibilities and scenarios and will continue to work on minimizing geopolitical risks to our business.”