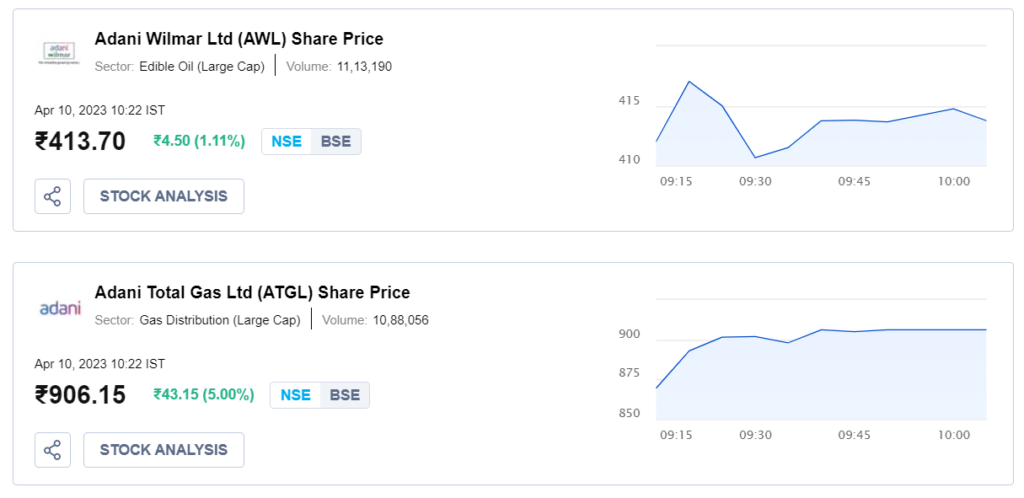

Monday morning will concentrate on Adani Wilmar shares after the Adani group company issued operational updates for the March quarter. Following the Centre’s decision to revise the domestic natural gas pricing guidelines, Adani Total Gas, another group company, will be on investors’ radar.

Adani Wilmar

Adani Wilmar reported that imports of edible oils were more stable in the March quarter compared to earlier in the year. It was stated that prices have decreased from historically high levels and have remained stable, resulting in a rise in consumer demand, particularly in rural areas.

Mustard, a key domestic oilseed, is anticipated to yield a record crop of close to 11 metric tons in fiscal year 2023, up 5 percent from the previous year. Adani Wilmar noted that wheat prices in the food segment began rising in July 2022, prompting the government to discharge wheat stock onto the market to increase supply, resulting in the normalization of wheat prices.

Adani Wilmar reported that the branded sales volume for the edible oil segment grew 4% for the March quarter, as a result of increased consumer demand and lower edible oil prices. However, the aggregate volume of oil sales decreased due to a decline in demand from the baking and sauté industries. According to the report, the Food business is executing well on its long-term plan and expanding its operations across India, registering a volume growth of 40% YoY in Q4FY23, with strong growth in key categories.

For fiscal year 23 (FY23), Adani Wilmar reported close to 14% volume growth, which enabled it to surpass Rs 55,000 crore in revenue. The Adani group company reported making significant strides in expanding its operations and acquiring market share for culinary products.

“The expansion of the culinary industry is exceeding our expectations. We have made significant strides in all new product enablers, including sourcing, manufacturing, distribution, brand development, and team fortifying. We ended FY23 with approximately Rs 3,800 crore in Food & FMCG segment revenue, registering a robust growth of approximately 40% YoY in volumes and 55% YoY in revenue terms, while seeding numerous new growth avenues throughout the year “it said.

Adani Total Gas

Following the Centre’s decision to revise the domestic natural gas pricing guidelines, Adani Total Gas, among others, has reduced CNG and PNG prices. Adani Total reduced the prices of CNG and PNG to up to Rs 8.13 per kilogram and Rs 5.06 per standard cubic metre, respectively. ATGL also announced a reduction of Rs 3 per scm in the price of PNG for industrial and commercial consumers.

A day after the Union government announced a revised new pricing mechanism for the majority of domestically produced natural gas by state-owned explorers, the prices were revised. According to the government, the new pricing structure will reduce the price of CNG and PNG.

ATGL praised the Central government’s decision to link the Administered Price Mechanism (APM) Price for gas supply to CNG vehicles and residential households to 10% of the Indian crude basket, with a minimum of $4 and a maximum of $6.5 per mmBtu.