Olin Corporation (NYSE: OLN) may not be the most well-known company at the present, but it has had substantial share price fluctuation on the NYSE in recent months, with highs of US$64.59 and lows of US$50.20. Certain share price fluctuations may provide investors with a better opportunity to enter the stock and maybe purchase at a cheaper price. The issue to be answered is whether Olin’s current market price of $53.35 reflects the stock’s true value. Or is it now undervalued, affording us the chance to purchase? Let’s examine the outlook and value of Olin based on the most current financial data to determine whether there are any price-changing catalysts.

What Opportunities Exist In Olin?

Excellent news, investors! According to my price multiple model, which compares the company’s price-to-earnings ratio to the industry average, Olin is still a bargain. I utilized the price-to-earnings ratio in this instance due to a lack of clarity into its cash flow projections. The stock’s ratio of 5.26x is significantly below the industry average of 12.39x, indicating that it is selling at a discount to its competitors. But, there may be another opportunity to purchase in the future. Due to the fact that Olin’s beta (a measure of share price volatility) is high, its price swings will be accentuated relative to the market as a whole. If the market is negative, it is possible that the company’s shares would decline more than the market as a whole, creating a perfect purchasing opportunity.

What does Olin’s future look like?

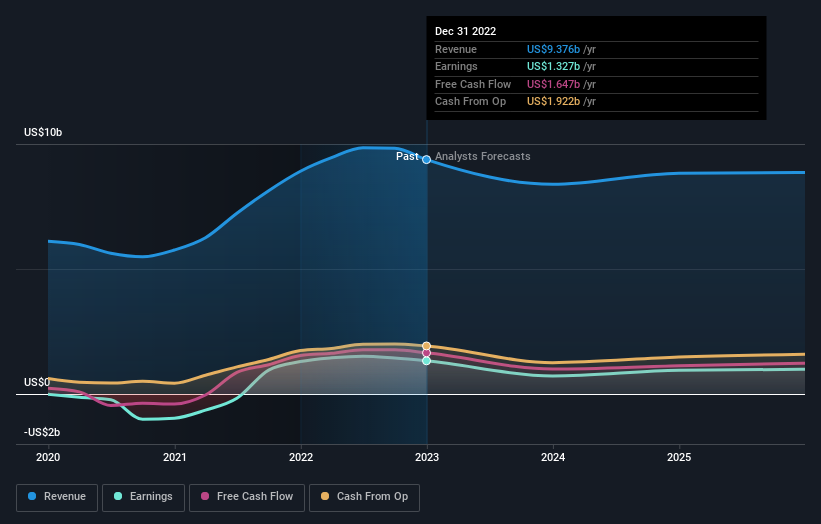

Prior to purchasing a company’s shares, investors seeking portfolio growth may choose to evaluate the company’s prospects. A cheap purchase of a fantastic firm with a solid perspective is always a wonderful investment, so let’s also examine the company’s future prospects. With a severely negative double-digit shift in profit anticipated over the next couple of years, however, near-term growth is not a factor in making a purchase choice. At least in the immediate future, it appears that Olin will experience significant uncertainty.

The Implications For You

Are you an investor? Despite the fact that OLN is now selling below the industry P/E ratio, the negative profit projection does create some uncertainty, which translates to a greater level of risk. Consider if increasing your portfolio’s exposure to OLN or diversifying into another stock would be a better move in terms of your total risk and return.

Are you a prospective investor? If you’ve been keeping an eye on OLN for a while but are afraid to invest, you should investigate the company more. With its current price multiple, this is an excellent moment to decide. But, keep in mind the hazards associated with low future growth possibilities.

In light of this, we would not contemplate investing in a stock without a comprehensive grasp of the dangers. Example: We’ve identified three danger signals for Olin that you should be aware of, one of which makes us uneasy.